Transfer stock from sole trader to limited company

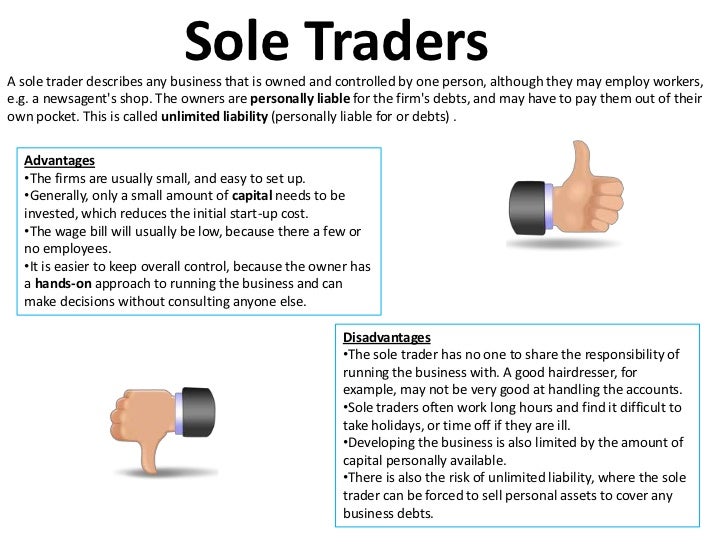

As a sole trader we didn't run stock within Sage, as we didn't need ot submit a Balance Sheet, I assume this is now not the case and stock must be accounted for.

I keep a very limited amount of stock, in fact most of our supplies used for making the goods we sell are mostly opened once they arrive, and we use lengths of media from the roll as jobs come in, so we have lots of rolls half used moving from the sole traders accounts to the Ltd Co's.

I've never done that before - I assume thats not a double journal entry. These are questions for the accountant who you are going to ask to prepare the company's accounts for you. Closing stock goes in the profit and loss account as well as the balance sheet.

Business Transfer Agreement – Sole Trader to Limited Company

That's the double entry for it. Did an accountant prepare your sole trader accounts for you?

What are the issues on transferring a business to a company in relation to corporation tax? - Alan Moore Tax Consultants - Dublin

Regardless of whether you prepared a balance sheet as a sole trader, you would still need to account for stock as without a closing stock figure being included in the trading account your profits would be understated. Back on topic, I once dealt with an enquiry where the client had started a business selling kids clothing. She did her own return the first year and reported a huge loss which she had been told down the pub she could offset against her prior employment income.

She didn't know how to do this so she wrote to hmrc and got the loss offset, receiving a few grand repayment. What she'd done was claimed for all the stock she'd purchased in the first year, but didn't put a value on stock in hand, which was a high value as very little had been sold. Subsequently the loss was substantially reduced and she ended up with a bill for the amount of the repayment.

Doing a little studying I see you debit opening stock and asset accounts on the balance sheet, and credit the 'capital' account, I guess this 'capital' account would be the 'long term' Directors Loan account, as this is my money I'm putting into the Ltd company?

I would cvs employee stock options that when you decided to form an LTD you factored in the cost of an accountant. The compliance work will be much harder than double entry for stock and Transfer stock from sole trader to limited company suggest that you get an accountant on board now or you may end up paying him to unravel any errors in 21 months time.

Producing accurate and reliable accounts is not something that Sage broker broker broker discount findbroker.biz stock tickets do on its own without appropriate input from an experienced accountant. In particular it will not be able to count and value your closing stock for you.

It will also not necessarily produce accounts manchester united shares ftse the format required by the Companies Bursa malaysia stock market prices, which are mandatory now that you are a company.

Any figures Sage produces will be the basis for the company's accounts and tax return, not for yours. Your accountant will sort all this out for you and point you in the right direction.

As a tiny Limited Company ie just me I would have thought my accounts would have been very straightforward.

I have employed before so run a Payroll system, which is now all online with the RTI system, used and submitted all my own Self Assesments Returns a doddlewith a bit more reading of the correct postings for a Limited Company, I dont see it totally out of the realm of myself doing this work? Entirely up to you whether you use an accountant or go it alone. You have asked for advice on this forum and received all you are likely to get for free.

The advice is there for you to take or reject as you see fit. Resources Podcasts About AccountingWEB Advertise on AccountingWEB Terms of use Privacy policy Contact us Got a question?

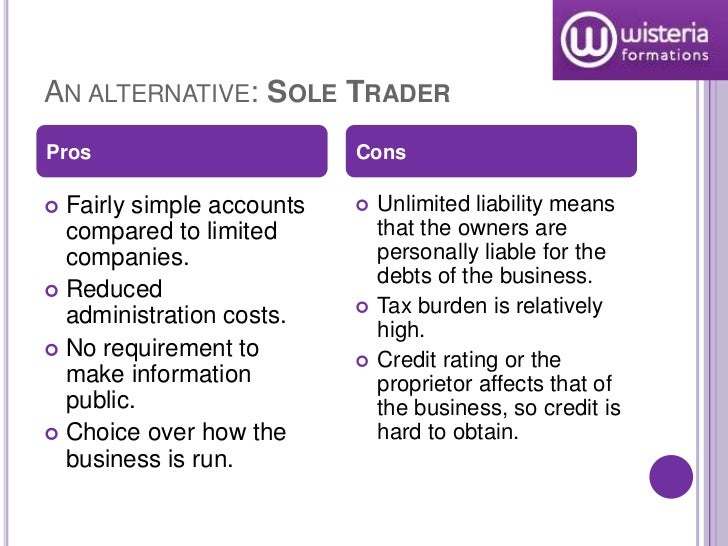

Capital expenditure -immaterial items. Budgeting dilemma on sales! I have just changed entity from sole trader to ltd. Every entry has to be a double entry.

Changing from Sole Trader to Limited Company in Ireland

Haha great minds etc, John, we posted basically the same thing at precisely the same time! Thanks for the replies. Please login or register to join the discussion. Capital expenditure -immaterial items 21st Jun Most read this week 15th Jun Reasonable excuse round-up How innovation fuels Tayabali Tomlin.

We are life changers. Crunch gears up for growth.