Journal entry for buying common shares

The amount or value listed on a bill, note, stamp, etc. Often times companies offer their stock for sale as a way to generate cash.

Issuance of Shares of Stock | Journal Entries | Examples

How the stock sale is accounted for depends on the type of stock sold. Most stock sales involve common stock or preferred stock. Credit additonal paid in capital to account for the difference between par value and sell value. The sale of preferred stock is similarly treated, but a separate accounts should be established to record preferred stock and any additional paid in capital for preferred stock sold at above par value.

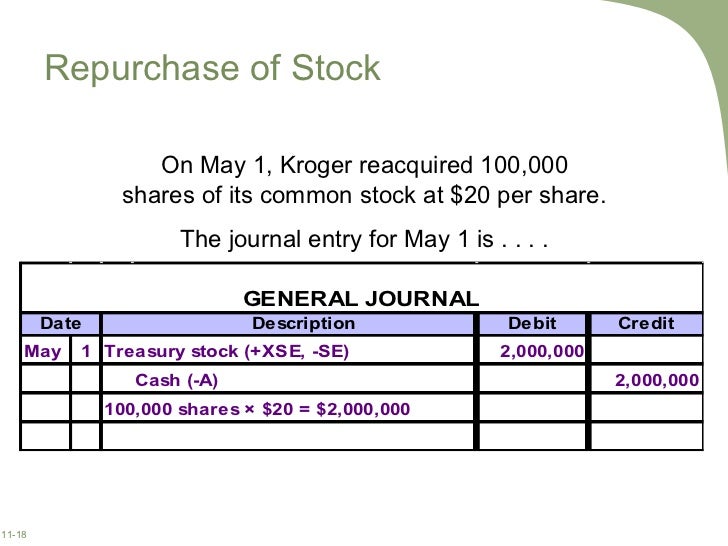

Treasury stock is issued stock that the company has bought back from its shareholders. Since a corporation can't be its own shareholder, the "bought back" stocks are not considered assets of the corporation. Treasury stock also doesn't have the right to vote, receive dividends or receive liquidation value.

If the company plans to re issue the shares in the future, it would hold them in treasury and report the reduction in stockholder's equity on the balance sheet. There are several reasons a company may purchase treasury stock, it may need it for employee compensation plans, to buy another company or to reduce the number of outstanding shares. When treasury stock is sold the accounts used to record the transaction will vary depending on whether the stock sold above or below the cost of purchase.

Boundless vets and curates high-quality, openly licensed content from around the Internet. This particular resource used the following sources:.

Except where noted, content and user contributions on this site are licensed under CC BY-SA 4. Valuation and Reporting of Investments in Other Corporations.

Read Feedback Version History Usage. Learning Objective Summarize how to account for the sale of common stock, preferred stock and treasury stock. Key Points For common stock at par value , debit cash and credit common stock. For common stock sold above par, debit cash, credit common stock, and credit additional paid in capital.

For preferred stock, debit cash and credit preferred stock. For sales of treasury stock , debit cash and credit treasury stock. Accounting for the Sale of Stock Often times companies offer their stock for sale as a way to generate cash. Prev Concept Accounting for Sale of Debt. Create Question Referenced in 2 quiz questions Why is "bought back" treasury stock not considered an asset on the company's financial statements?

What accounts are used to record a sale of common stock at above par? Key Term Reference Assets Appears in these related concepts: Unsecured Funding , Defining Long-Lived Assets , and Defining the Marketing Objectives. Recording Transactions , Fundamental Accounting Equation , and Closing the Cycle. Managing to Prevent Fraud , Flow of Inventory Costs , and Disadvantages of LIFO. Activity Ratios , Goodwill Impairment , and Shifts in the Money Demand Curve. Impact of Depreciation Method , Defining the Cash Flow Cycle , and Balance Sheets.

Terminology of Accounting , Working Capital Management Analysis , and What Is Cash? Honor and Violence , The Post-Closing Trial Balance , and Developing Services. Reversing Entries , The Trial Balance , and Journalizing.

Debt Utilization Ratios , Deficit Spending, the Public Debt, and Policy Making , and Collection from Delinquent Payables. Defining Dividends , Investor Preferences , and Division and Factors.

Motivating and Compensating Salespeople , Civil Law and Criminal Law , and The Psychology of Employee Satisfaction. Posting , Redeeming at Maturity , and Inputs to Accounting. Recognizing Notes Receivable , Reconciling Cash Accounts and Bank Statements , and Reporting Fair Value.

Bankruptcy and Bond Value , Convertible Stock , and Preferred Stock Rules and Rights. Characteristics of Bonds , Call Provisions , and Accounting for Preferred Stock.

Journal Entry for Purchase of Common Stock? | Yahoo Answers

Defining Management , Arguments for and against Corporate Social Responsibility , and Types of Stakeholders. Issuing Stock , Dividends Payable , and Repurchasing Stock.

Sources Boundless vets and curates high-quality, openly licensed content from around the Internet. This particular resource used the following sources: Subjects Accounting Algebra Art History Biology Business Calculus Chemistry Communications Economics Finance Management Marketing Microbiology Physics Physiology Political Science Psychology Sociology Statistics U.

Money A2Z

History World History Writing. Products For Students For Educators For Institutions Quizzes Integrations. Boundless About Us Approach Partners Press Community Accessibility. Follow Us Facebook Twitter Blog. Visit Support Email Us. Legal Terms of Service Privacy.