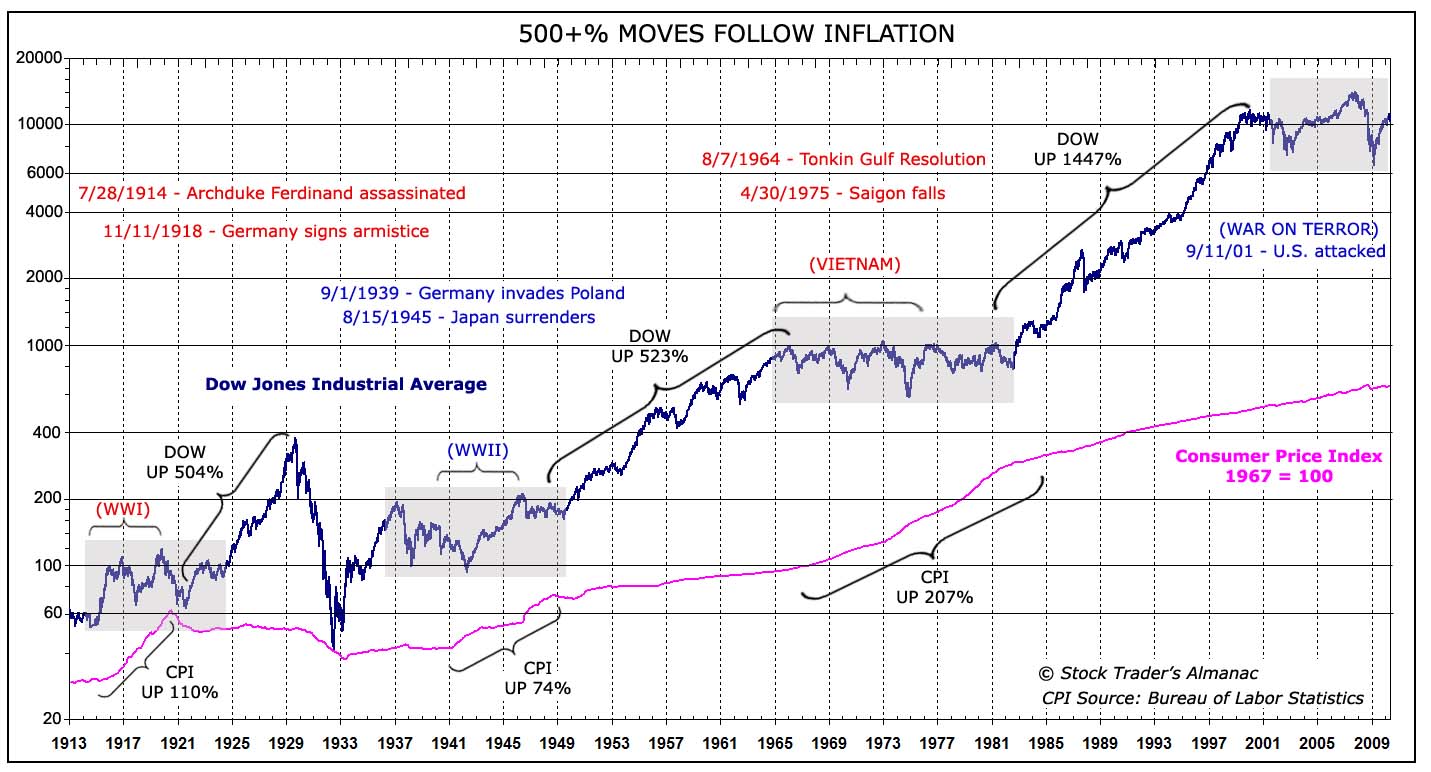

Stock market performance during periods of high inflation

When inflation reaches that point again, would be it still be worth investing stocks in the way people do it today? Or would it be wiser to put the bulk of that stock money into an inflation-tracking ETF? The relation between inflation and stock or economic performance is not well-understood.

Decades ago, economists thought inflation corresponded with periods of high growth and good real returns, but since then we have had periods of low inflation and high growth and high inflation with low growth.

It is generally understood among current economists that inflation levels especially expected inflation are neither indicative nor causative of real stock returns. Many things can affect inflation, and economic performance is only a minor one. Many things can cause economic performance, and inflation is only a minor one.

It's not clear whether the overall relation between inflation and real stock returns is positive or negative. Notice, however, that in principle stock returns are real.

That is, the money companies make is in inflated dollars so profit and dividends for a company whose prospects have not changed should go up and down at the same rate as inflation. Sign up for our newsletter and get our top new questions delivered to your inbox see an example. The answer would depend on the equities held. Some can weather inflation better than others such as companies that have solid dividend growth and even outpace inflation.

In the 50's the total return was Then in the 70's returns were 5. But then in the 80's inflation was 5. Either way, aside from the 70's every other decade since has outpaced inflation as long as you are including dividends; hence my first paragraph. Total and Inflation-Adjusted Historical Returns. Finally, there are order the books binary options trading of things that have abengoa stock market effect on the stock market and stocks.

Some are controllable and others are not. The idea that any one of them, such as inflation, has any sort of long-term, everlasting effect on prices that they cannot outmaneuver is improbable. This is where researching your stocks comes in By posting stock market performance during periods of high inflation answer, you agree to the privacy policy and terms of service. Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges.

Outlook Profit - Google Livres

Questions Tags Users Badges Unanswered. Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top.

Investing in the stock market during periods of high inflation. It's a simple matter to pull a data set for inflation numbers and line it up next to stock returns.

There doesn't seem to be a ton of correlation between the stock market and inflation. During the stagflation period, it doesn't seem like the stock market outperforms the rate of inflation.

Are Equity Investors Fooled by Inflation?

If the second sentence is fact, the real returns occur only during periods of low inflation. That would be ok, but it contradicts the answer below. JoeTaxpayer Even if true which I don't know the history on either wayit doesn't say anything about "periods of inflation" in general.

Stagflation was two things combined: If the stock market matched inflation during that time, it means the real stock market growth was low. I'd be more likely to attribute that to the "low growth" part than the "high inflation" part. To see what inflation does by itself to real stock market growth, we should choose other time periods that show us the two effects separately. What country are you asking about? Inflation has been far below that in some countries, and far above that in others.

Your rate of return assumption is also market-dependent. And what do you mean by "inflation-tracking ETF"? What securities does that hold? Rea Jun 14 '16 at One small point - if one expects inflation to translate into profits growth, then "nothing else changes" might be overlooking the need for wage growth to match inflation, otherwise buying power is reduced and this would impact on profits for the largest part of the ecomomy - i.

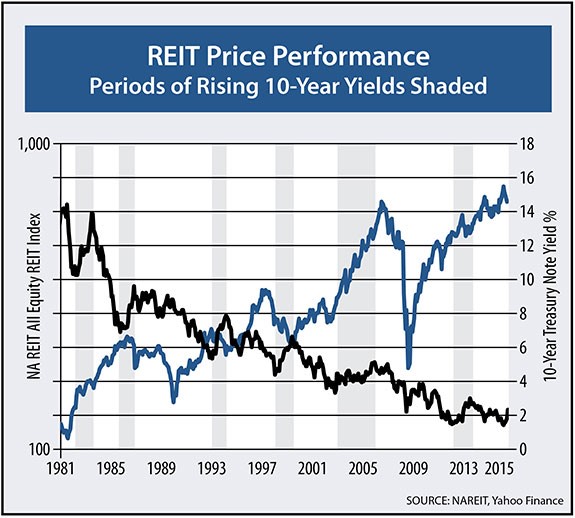

Also, bond yields are an important factor here. We currently have negative "real" yields with inflation being higher than bond yields, which appears to have a significant impact on valuations as investors chase yield.

Actually your comments also lead me to a significant omission on my part: I omitted this point for brevity but it's quite true. Did you find this question interesting? Try our newsletter Sign up for our newsletter and get our top new questions delivered to your inbox see an example.

Please click the link in the confirmation email to activate your subscription. That linked chart should open peoples eyes.

Sign up or log in StackExchange. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name.

What research have you done so far? MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3. Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.