Option trading covered calls

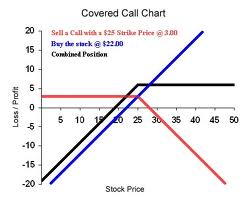

A covered call is an options strategy whereby an investor holds a long position in an asset and writes sells call options on that same asset in an attempt to generate increased income from the asset.

This is often employed when an investor has a short-term neutral view on the asset and for this reason holds the asset long and simultaneously has a short position via the option to generate income from the option premium. A covered call is also known as a "buy-write". Consequently, this strategy is not useful for a very bullish investor.

How to sell covered calls - Fidelity Investments

A covered call serves as a short-term small hedge on a long stock position and allows investors to earn a credit. However, the investor forfeits the potential of the stock's potential increase and is obligated to provide shares to the buyer of the option if it cysec binary options regulations exercised.

The maximum profit of a covered call is equivalent to the strike price of the short call option less the purchase price of the underlying stock plus the premium received. Conversely, the maximum loss is equivalent to the purchase price of the underlying stock less the premium received. One of three scenarios is going to play out:.

In this case, by using the buy-write strategy you have successfully outperformed the stock. To know more about covered calls and how to use them, read The Basics Option trading covered calls Covered Calls and Cut Down Option Risk With Option trading covered calls Calls.

The Basics Of Covered Calls

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund.

Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Ep 99: Trading Covered Call Options with Stocks You OwnBear Call Spread Option Premium Call Ratio Backspread Call On A Put Writing An Option Call Price Sell To Open Put On A Call Call On A Call. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator.

Covered Call | Options Trading at optionsXpress

Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.