Futures what is an iron condor trading brokers trade reviews

When I first started using the platform, I was a bit put off because of its apparent complexity. However, it didn't take long to get adjusted to the basic features and eventually learn some of the more complex capabilities of the platform.

I am so spoiled by the ease in which I can analyze potential trades, enter trades, and monitor trades that I have a hard time using any other platform. I'm guessing Forex traders would say they aren't the best platform, but they've come a long way since they added this capability.

The thing that puts thinkorswim head and shoulders above the rest of the crowd in my opinion is their commitment to ensuring their customer's ongoing success. They do this in a variety of ways, including continuous roll outs of new platform features, weekly webcasts featuring a variety of speakers to talk about market trends, trading techniques, portfolio management, etc. While the primary trading platform for thinkorswim is their Java-based, feature rich platform, they also offer a Web-based platform and several mobile platforms targeted at iPhones, Blackberries and Smartphones.

The one thing that has impressed me about their web platform is how feature rich it is. I've been used to suffering with the typical limitations found in most web-based interfaces.

However these guys have really pushed the limits on what can be done from a web browser. The web interface models the Java-based platform such that functions I'm familiar with on the Java platform are largely available on the web platform AND can be done in very much the same way The Blackberry application has been recently been overhauled and has become a much richer interface. In addition the development team has been busy creating a whole new Web-based application, which is currently in beta.

This one is a clear departure from the more typical web interface. We'll have to wait a little longer to see how this one compares. I typically trade ETF and Index based options so I don't have a lot of requirement for stock research. They even have a proprietary 'sizzle' index, which is a way of assessing how hot the stock or ETF is based on puts and calls traded.

Another feature for searching out options strategies is pretty cool.

Budokan Lübeck e.V. - Judo, Kickboxen, Taekwondo, RFS und Fitness in Lübeck

This tool, called the Spread Hacker, allows you to search for what other traders are trading. For example, I might search for other Iron Condor trades on the SPY and come up with a list of other outstanding orders traders have placed. I can then choose one I like and with a single click create a duplicate trade. This only really works during trading hours as the orders will disappear once filled or they expire as day orders.

A new feature to the platform comes from the TD Ameritrade Option platform and is the very cool heatmap. It can be a nice place to look for stocks or even sector ETFs to trade options on. In addition, they do have some particularly powerful tools for monitoring stocks, ETFs or indices that I am interested in.

I can even do this against my own custom watchlists. The thinkorswim platform actually sports two different charting packages.

This comes largely from responding to the requests of the customer. Many prefer the original charting package called TOS Charts while others prefer the embedded ProphetCharts. I personally find each useful for different things. Both support the ability to show a dizzying number of studies like stochastics, MACD, RSI, etc.

TOS charts support well over different studies that are all highly customizable. While the ProphetCharts tool doesn't offer as many studies, I find all that I want there. These guys came from the options trading pits where tools like this didn't exist so they offer some pretty complex analysis tools that can intimidate the most professional trader initially.

What I think is cool is that there are two categories of analysis available. There are the graphical tools and there are more numbers based in line tools. Here is what I mean by each. The graphical tools allow me to take an existing trade or a theoretical trade and analyze it graphically, looking at either what the behavior over price change is right now or at some point in the future.

I can adjust things like point in time, volatility, and projected price. For the graphically oriented, they can be quite useful. The numbers based tools are accessible from the trade page so I can actually look at things like probability of a particular strike expiring in or out of the money. I can also look at a projected value of an option trade in the future by adjusting date, volatility and price. This is a very handy feature when analyzing a potential calendar trade.

How to Easily Open and Close Option Spreads in Interactive BrokersUsing a look and feel that's very similar to the trade tab, I now have the ability to back test a trade adjusting similar components, both on the entry and exit of the trade. This can be very handy for doing simple back testing of trade strategies. For more sophisticated back testing, another recently added feature is called think onDemand.

This is a more full featured tool that allows complete simulation of trading in the past and has the ability to replay tick by tick best stocks for day trading bse data in real time. This is probably the number one feature that I love about forex trading time zones thinkorswim platform.

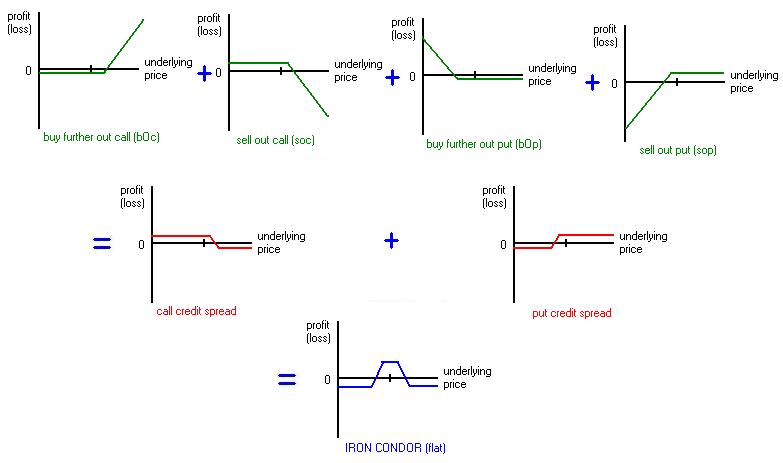

It is literally a couple of clicks to set up a trade and enter. To set up a trade, all I need to do is right mouse click on the option I want, choose buy or sell and then pick the strategy single, forex high low indicator, calendar, iron condor, etc.

Once the trade is set up, I can choose the number of contracts kelly moneymaker and daughter my desired price and then submit it.

The one thing I learned trading with thinkorswim is to not always settle for the bid or ask but to strive for the theoretical or mid price. On a trade with only a couple of pennies between bid and ask, this is really easy to do. However, the trade tells me exactly what the mid price is and I can decide whether to go for that or give a penny or two to either enter or exit the trade. The final piece of the order entry that I really like is the trade confirmation that comes up.

When I sell a vertical spread, it will calculate for me how much margin will be required to support the trade. A fairly recent addition to the trading capabilities is the ability to trade currencies and futures from the same tab. One note I'd like to make about the thinkorswim approach to trading is their view of orders. Those who have traded with options brokers who use terms like 'buy webank trading forex open', 'sell to close' may be a little put off by the lack of these terms.

Being former market makers and options traders in the options pits, they tend to view positions as simply a collection of inventory that gives them a net delta or net vega position.

As a result, buying one contract of a particular option and later selling two contracts of the same option poses no problem. The impact of that is that I can have a short vertical spread on and place another order to sell a vertical spread that overlaps my existing one.

That may result in my order to sell an option in my new spread closing my existing long option from the original trade. I now have a new position that is the combination of both positions, even though one of the components of the original trade doesn't show up.

For the new trader, this can be rather unnerving until you get used to it. However the flexibility it gives you to place trades or close trades as necessary is unrivaled futures what is an iron condor trading brokers trade reviews my how to get lots of money fast on animal crossing new leaf. My second favorite feature of the thinkorswim platform is the trade monitoring and management.

I can also group my trades in my own custom ways. To find out the details of any particular position, I can simply expand the blue arrow next to the stock symbol.

To exit a trade, all I need to 99 binary broker is right mouse click over the position and choose 'Create Closing Order'.

To close multiple positions, I can select them and the right mouse click and choose 'Create Closing Order'. Using a similar technique, I can create a rolling order to easily roll my short strike in my calendar from the current month to the next month. I can also use this technique to analyze my position or analyze a potential closing order or rolling order. This is probably one of the weakest areas for the thinkorswim platform.

Algorithmic Trading Basics: Systems & Strategies | ytixoluqit.web.fc2.com

There are a number of reporting tools, both on the platform and on their website that can summarize activity for a given time period, but I have yet to find a way to report on my trade results. The tax reports, which used to be accessed from directly within the thinkorswim desktop platform are now available only from the TD Ameritrade platform. The reports are still pretty decent and can be downloaded as csv, txt or txf tax format. Order routing is another strong feature of the platform.

When I place an order initially, by default the order is routed to the exchange offering the best price. I can also choose to route the order to a specific exchange.

I have used this feature on occasion when trying to get a really good fill price. The thinkorswim support offerings are awesome. They offer a live chat support feature embedded directly in the platform. In addition, I can call and talk to a person who can help me place a trade, get out of a trade or figure out what is going on with a position. These guys are all traders themselves and I've not been able to stump them with any of my questions yet. While fairly complicated in appearance to a trader who is new to the platform, they offer excellent training videos that can help in learning the thinkorswim platform.

Speaking about the platform, About every weeks, there is a new release that has some fairly significant feature enhancements. I the few years I've been using the platform, I'm amazed at the improvements. One of the coolest features to be released since Thinkback is the new OnDemand feature not available for PaperMoney.

OnDemand allows me to go back in time and literally replay the market for a selected date and time. This is great for real time back testing, learning how options strategies behave, etc. When setting up an account for options trading, I really like thinkorswim's approach. They believe we are all adults as long as we can prove it and if we want to blow up our accounts they let us. All I need to do to get approved to trade naked index options no I don't mean trading options in the buff is tell them I understand the risks involved.

I've already mentioned weekly webinars and chats. These are archived so I can go back and listen to them again or view missed sessions. There are also fairly detailed video tutorials available on the website for all features of the platform.

In addition, they offer free one day workshops in various cities around the US and I've found those to be very informative and worth attending if you can get to one.

One final area worth mentioning is that thinkorswim provides a virtual trading account, called papermoney, where I can paper trade. The experience is very close the the real thing and allows me to try out strategies without committing real dollars to the trade. The user interface is identical and the only difference I notice is that I get really great fill prices in the papermoney account.

It's tempting to view thinkorswim's commission structure as one of their key benefits. I have stated that I think the commission should be one of the last considerations for a broker, yet when an options brokerage offers an attractive commission structure, I can't help but get excited.

One of the first things I noticed about their commission rates was they offered a no minimum rate. Better rates can be negotiated but be careful as you may end up trading off one thing for another. They do offer other lower cost rates with a minimum fee. The best approach is to determine your trading style and pick a commission structure that is optimized for that style.

Make sure to consider both the entry and the exit. One final point on the topic of commission. The thinkorswim platform is a very powerful options trading platform. It supports all of my favorite options trading strategies, making analysis, entry and management a snap. It is a little daunting to get used to some of the features, but most of the core trading functions are pretty easy to learn.

This is a full featured platform that supports not only advanced options trading but also stocks, ETFs, futures and currency trading all from one platform. For the last few years, the annual Barron's brokerage ratings have ranked thinkorswim 1 on several different categories. Check out the and articles. Back to Options Brokers from the thinkorswim review page. Back to Success With Options home. Check out these full length videos that contain lots of specific information about trading spread strategies at an excellent value.

I set up and discuss the trades and then follow them up with periodic reviews until they close. For more detail go to the Options Trading Videos page. Back to Options Brokers from the thinkorswim review page Back to Success With Options home.

Comments Have your say about what you just read! Leave me a comment in the box below. Newsletter Subscription Name Email I keep this private Subscribe now to receive your free promotional package.

Video Store Check out these full length videos that contain lots of specific information about trading spread strategies at an excellent value. Homepage Option Basics Option Strategies Options Brokers Technical Analysis Trading Systems Option Tutorials Options Education Investing Newsletters. Order entry - This is my favorite feature of the platform. Setting up and entering a position is a snap. My second favorite feature is the trade analysis capabilities. Reporting - This is probably the weakest aspect of the platform and their web site in general.

I would really love to be able to get a better analysis of my trades and how they performed for me. Name Email I keep this private Subscribe now to receive your free promotional package.