Employee stock option cliff

Jay Bhatti is a serial entrepreneur who has built startups on both the West and East Coast. One of the most exciting aspects of joining a startup is getting stock options.

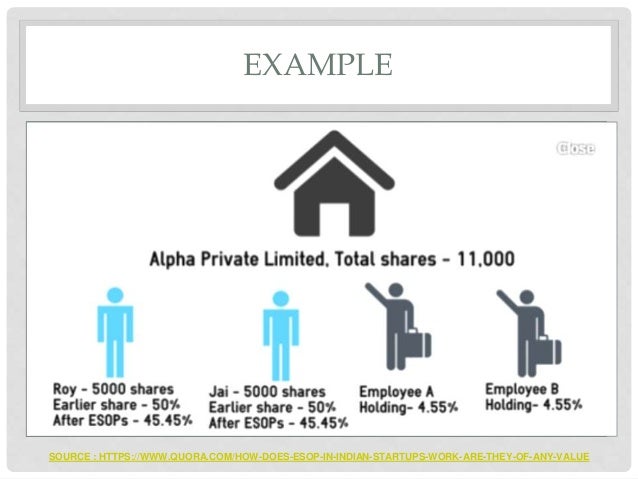

It gives you ownership in the company and aligns incentives between management and employees. However, one part of the standard options package causes a lot of debate amongst employees and management. A typical options vesting package spans four years with a one year cliff. A one year cliff means that you will not get any shares vested until the first anniversary of your start date. After that, vesting occurs monthly.

Many startup employees hate the one year cliff. Managers and VCs like it since they think employees will work really hard to make sure that they reach the cliff date. Employees, on the other hand worry that management will let them go just before they reach the cliff. The sad thing is that I have seen this occur at startups. You have an employee who is decent, but not great. Many managers see this as a way to make sure stock is only going to employees who are worth it.

You took the risk of joining a startup and they let you go just weeks or days before the cliff. In most cases, there is not much you can do. It was written in your employment agreement and you signed it. On the other end of the curve, I have known people who join startups early, but only stay a little over a year and then go join another startup. They call it hedging their bets. One person I know worked at Facebook for only a year in and then quit soon after his cliff date.

While he probably made a lot from the shares that had vested, he probably would have made more had he stayed. It makes them worry about losing other employees who might now be considering the same. As you approach the cliff date, you notice a lot of interesting things happen. In some cases, before the cliff date, an employee will go out of their way to work harder to show their value, or stay out of sight and not cause attention to themselves. After the cliff date, management is usually looking at their employee and hoping that they are happy and not considering jumping ship.

The time right before and after the cliff is interesting to say the least for a lot of startups. At my first startup, if we let someone go due to performance before their cliff date, we gave them shares in the company equal to the months they were with us. Thus, we made it as if there was no cliff date at all.

We did this for a few reasons. First, if we let someone go but they tried their best, yet it was just not a good fit, we saw no reason not to make sure they stay aligned with the interests of the company. In fact, some of the people we let go did help us in other ways once they left.

Furthermore, in some cases where you think the employee is not happy at being let go, you can make the shares conditional on them signing a waiver of some sort. Finally, we just thought it was the right thing to do.

One of the other things we did, and I am sure we were rare in this occasion was to give a 6 month cliff to employees who we really liked and wanted to recruit.

Vesting - Wikipedia

It made them feel more comfortable joining us, and gave them the sense that we wanted them long-term. It turned out to be a good recruiting tool to ingrain trust.

How Startups Should Deal With Cliff Vesting For Employees - Business Insider

In addition to employees, if the founders of a startup raise venture capital, they also go under a vesting schedule imposed by the VCs. Most of the time, if the entrepreneur is experienced in negotiating, they can ask for credit on their vesting for the months they were working in the concept prior to financing, and also waive any cliff in their stock. I have seen the founder of one very well know startup get kicked out by the VCs with only a year of vesting under his belt. One thing I do recommend to founders who do not plan to raise VC capital, is to put yourselves on a self-imposed vesting schedule.

How many stories have you heard about one founder leaving early but getting the rewards of the other founders work and effort.

Only because they both signed up as equal partners from the beginning. A good recent example is Paul Allen, where in his new book he talks about how Bill Gates tried to take away his stake in the company, since Gates thought Allen was no longer worthy of those shares due to lack of time in the office a result of illness and other interests.

If each founder of a self-funded startup has to earn their equity, it can save a lot of potential issues down the road, and also give each founder the feeling that everyone is motivated to earn their equity. To people looking to join a startup — Remember that joining a startup is a lot about trust and relationship.

To founders taking venture capital — Almost all VCs will ask you to go on a vesting schedule. Their biggest fear is writing you a big check and then one of the founders jumping ship early with a lot of equity. Make sure that the VCs vision of your company is aligned with your vision. If you have doubts about your VC at the honeymoon phase when they give you capital , imagine what might occur when things are not going so well!

If you have been working on your start-up for some time before raising a round of capital, then make sure to ask for credit on the months you have already put into the business.

Put yourselves on a vesting schedule. This makes sense to a lot of founder and helps align long-term interests. Tech market is nowhere near the dotcom days. How augmented reality is changing the way we work. You are using an outdated version of Internet Explorer. For security reasons you should upgrade your browser.

Please go to Windows Updates and install the latest version. Trending Tech Insider Finance Politics Strategy Life Sports Video All.

You have successfully emailed the post. How Startups Should Deal With Cliff Vesting For Employees. May 7, , 9: Recent Posts Startups Are Getting Sick Of NYC's Dirty, Overcrowded Co-working What Type of VC Are You Dealing With? NYC's Moonit Labs - TechCrunch Semi-Finalist Passes 1 Million Users Recommended For You Powered by Sailthru.

How Startups Should Deal With Cliff Vesting For Employees How Startups Should Deal With Cliff Vesting For Employees It can affect company morale if you're not careful.

Thanks to our partners. Registration on or use of this site constitutes acceptance of our Terms of Service and Privacy Policy. Disclaimer Commerce Policy Made in NYC. Stock quotes by finanzen.