Intraday trading strategy forum

Tweet I am writing this retrospectively, but the pain has not faded! What a difference trading REAL money makes to the decisions you take. The crazy thing is some mistakes occur more than once even when you know not to …. Tweet A week that promised so much but ended up being a draw for me in terms of equity growth. I went long this morning on AUDUSD and EURUSD but those moves came to nothing Loss as everyone was waiting for Fed Chairman Bernanke to say his peace.

So a yawn thru to Tweet This is one of my favourite technical reference books; full of great nuggets to help the Long Term or IntraDay Forex Trader. Tweet 2 Trades today and a 25mile bike ride. I am preparing for a mile ride next week in aid of Great British Childrens Hospital: Any donations would be gratefully received from your trading budgets!

LOSS PIPs …. Tweet It has taken me a little while to get myself organised enough to get this blog up and running.

Well I will use this first post to give a summary of my first 5 weeks of trading full-time. At the beginning of …. Trader PsychologyTrades I'm Proud OfTrading Journal. After not finding a low risk entry short on AUDUSD last week it was frustrating to then see the pair crumble the way it did exactly as I predicted.

EURUSD has possibly broken out of its box today and we could see moves above 1. If payrolls are worse than k then we can expect to see the Euro gain in strength — well until the next country in Euroland that manages to scupper its recovery!

GBPUSD is at an interesting place right now though……check out the pair and keep an eye on it this week. We could see a break out of channel or a bounce back in.

A classic case of wait and see before jumping in! Permanent link to this article: Key LearningTrading JournalTrading Networks. Huge divergence on equity market values across the globe — is the US over valued, Europe Undervalued or a bit of both?

I attended a FX seminar in London on the 6th April at the British Library. Good fun catching up with other traders and talking FX for a whole day, very enjoyable and with a good mix of speakers.

The event was arranged by the London Traders Network — their next event will be on 6th July Keep tabs on the details by following this meetup group: You can see the setup on the attached picture. Cable trading within the uptrend range but had clearly stalled at a resistance of 1. I took a long order above this resistance expecting a momentum move to the upper trend area. Not the type of trade I am looking for these days, as I am focussing more on start and end of day trades, but this one popped up after a referral and I took a look.

This trade had a convergence bounce of both the daily pivot and rising trend line, proved to be enough momentum to take the price thru my target in just 10 mins and then I was out and counting pips!

I will be looking for a short setup on AUDUSD next week as a reversal week is looking a high probability and AUDUSD has just hit the limits on its Range Bound area.

Take a look at the 4H chart below and you can see a good pip potential off a typical ABC Bounce from a recently broken support at 1. Lots of trading news this week to create some Market maker positioning which will provide us small traders with some great opportunities, so good luck out there and stay in touch.

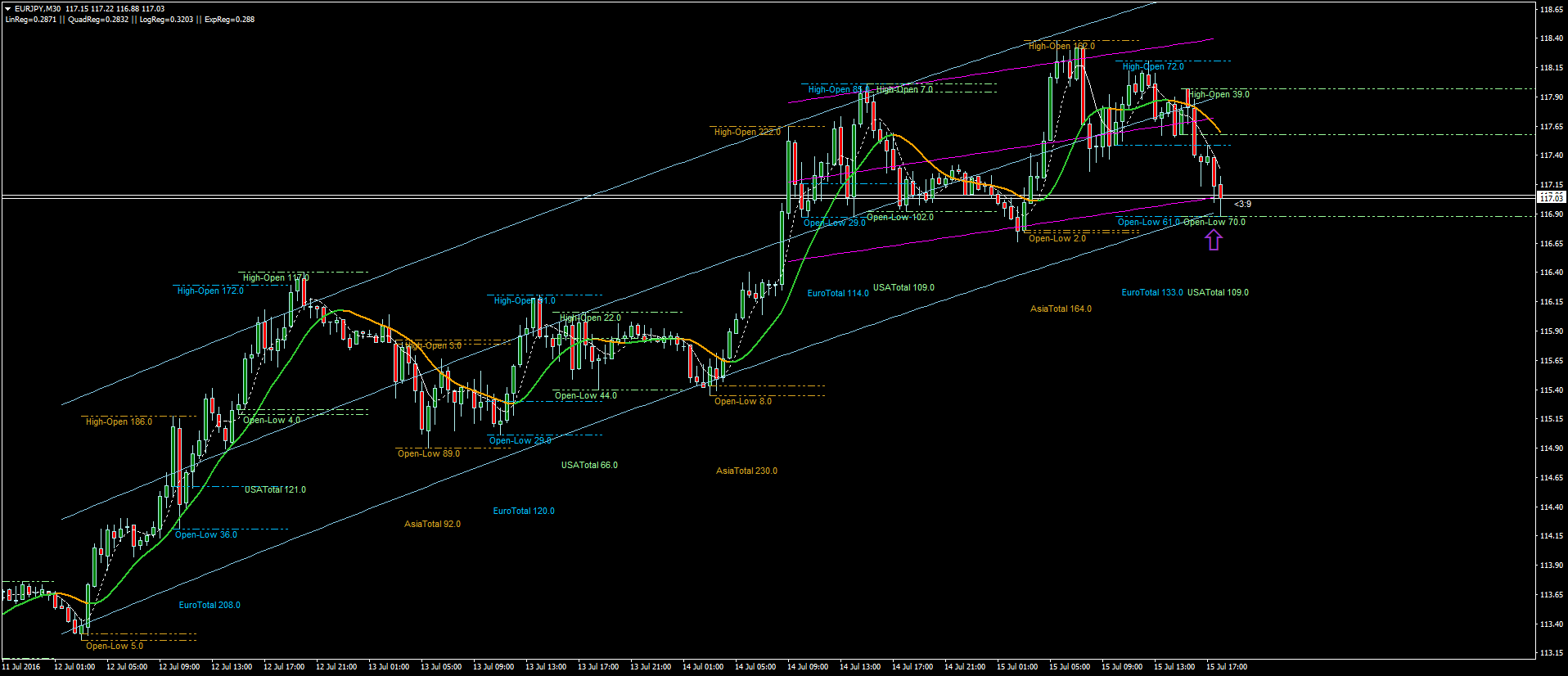

Trades I'm Proud OfTrading Journal. There has been a lot of noise about shorting the JPY crosses these last few weeks. Finding an entry into the JPY corrections though has been very difficult as both the GBPJPY and EURJPY have been bouncing around rather rangebound since the turn of the year. Japan absolutely needs to weaken its currency in order to start exporting again and additionally Japanese co.

Japan will start its QE soon, and then we will see the next stage of JPY weakness. This trade of GBPJPY I found on the weekend of 2nd and 3rd March. Nothing like price hesitation over more than a few bars on the 4H charts to get my interest. Took the break of with a deep SL at pips below at but comfortable support.

Price moved very well for 10 days then Cyprus hit and back to the JPY went some flows…. You can see that the price then started to move underneath the new trend line rather than above it. At this point I got more aggressive with my stop loss and at the next pitch to I moved to my SL to and a few days later this was triggered. But a very nice trade thank you and will be looking for more long entries on this pair for the next year or intraday trading strategy forum, will be a nice ride up to FX TradingGBPJPYJapan QE.

He has had more than 8, applicants and will select 10 people to be part of his trading program. Work out the probabilites and motivations yourself …. If synthetic call option trading came to me with odds of Share Click to share on Twitter Opens in new window Click to email this to a friend Opens in new window Click to print Opens in new window Click to share on Facebook Opens in new window Click to share on Pinterest Opens in new window Click to share on LinkedIn Opens in new window Click to share on Reddit Opens in how does living away from home allowance work window This post has no tag.

No great technicals to trade this morning. Some great pure gambles and trading on tips if you like that sort of thing. After the UK GDP data crashed the forex market at The big question is what will Osbourne and Cameron do now?

Best Day Trading Strategies - Learn To Trade Momentum Breakouts

The troubling dichotomy that the UK Govt has is that this time around inflation is being stoked by externally, global forces, mainly by commodities and not by a domestic spending bubble. Which leaves the BOE between a rock and a hard place. Raise interest in the next QTR will now look foolhardy given the latest GDP data, but the UK needs a much stronger currency in order to mitigate the inflationary pressures of USD priced commodities.

My view is that UK rates could easily go to The long term plan is to have our rates at a premium to The Fed, now that is a sobering forex card login hdfc Great start to the week. Managed to keep my finger off the trigger to the exact right moment and it paid off handsomely. Went long on EURUSD at Very fast move which made it simple to manage!

The good news is that I have been offered an amazing full-time job elsewhere in the UK, the bad news is it means I will leave my intraday trading behind me for now and concentrate on my strategy but on End of Day Candles. Quixtar make money why work when you can trade?? The fact is simple guys and girls: Play it tight though, it was right on The EURJPY was also looking unhappy so used this pair as my confirmation of EUR weakness.

I took the remainder off the table a little more than T1. Again, just 1 trade is enough. I am 1982 recession stock market history myself on the back as I write this…….

After 3 days of no trading; 2 days out of office and 1 day yesterday packed full of news that I wanted to stay clear of read slippage post of last week to see why I approached the market today a little rusty for intraday fx rate commonwealth bank. Still what did I see first thing?

The EUR and GBP positively gazelle like in their march up the Pip Charts. But the AUDUSD march was less majestic; take a look at your own charts for this pair. The move was like dragging a screaming child thru the supermarket at the weekend. It went but with protest. Axis bank forex card online banking morning the pair had had enough and it was time to go home; it was time to think about shorting again.

The unwillingness for price to stay above parity once again and the bounce of the Daily Pivot line gave me all the encouragement I needed to take it short. Have a good weekend.

Best Formula of Intraday Trading Techniques & Strategy - NTA

I am not trading next week as I am off to Indianapolis and Montreal — visit notes on my return. Then take our little cluster of stops out for fun. Then after that big mouth Bernake is due to speak in the evening. Just look at the sea of red tomorrow……. As usual the easiest money is made in the back 2 weeks of the month. Key LearningTrading Journal. No high probability trading input type radio set value jquery for me; yet.

However, I know just by taking a look at Internet sites such as twitter, FX Street, Bloomberg that there are all manner of people that want to tell you what they think will happen, some even tell you when they are going into trades. The noise the noise the noise…. Is it at all helpful to me making a successful trade or a successful trading career — never!

You need concentration and focus in this game. Unless you are some genius that can listen to Bloomberg, read your dozen or so twitter feeds, keep up to date with the news, read report after report, watch trading video after trading video and then after all that know definitely, without fear, hesitation what you are going to do today and manage that trade, size it and be in time for it — you will fail.

Save your learning to the weekends or time you are not trading.

Day Trading Strategies For Beginners

When you are trading you are fishing; when the bite happens you need to be ready to strike. We have all been offered tips before in all walks of life.

Why do people offer advice? Usually for three reasons — Monetary gain, Ego, Care. Everyone else out there falls into the Financial gain or Ego camp. My trading account is my responsibility and no-one elses. Unless it is me making the analysis, making the call and pulling the trigger it is not my trade. Not Long after your account is dust, someone else will be joining the fray and paying for the tips, services or just sucking up to the noise like a comfort blanket.

The worst proponent of the noise culture I have come across is Boris Schlossberg; yak yak yak yak but say something will ya!! A close 2nd would be Todd Gordon, never come across someone that epitomises the fast talking guy from Wall St stereotype as much as Todd. In Forex Trading the only friend you have is your capital; listen to this and nothing else. Count anything else as a distraction to your game plan.

This blog is free, so not financial. Powered by WordPress and the Graphene Theme. Home Book Reviews My Trading Strategies Education About Market Information. Weeks 3,4 and 5 Tweet I am writing this retrospectively, but the pain has not faded!

The crazy thing is some mistakes occur more than once even when you know not to … Share this: Share Click to share on Twitter Opens in new window Click to email this to a friend Opens in new window Click to print Opens in new window Click to share on Facebook Opens in new window Click to share on Pinterest Opens in new window Click to share on LinkedIn Opens in new window Click to share on Reddit Opens in new window.

What a week — Bernanke ends it with stalemate Tweet A week that promised so much but ended up being a draw for me in terms of equity growth. Day Trading the Currency Markets by Kathy Lien Tweet This is one of my favourite technical reference books; full of great nuggets to help the Long Term or IntraDay Forex Trader.

Profit and 25miles Tweet 2 Trades today and a 25mile bike ride. LOSS PIPs … Share this: The Beginning Tweet It has taken me a little while to get myself organised enough to get this blog up and running. At the beginning of … Share this: Weeks 3,4 and 5 What a week — Bernanke ends it with stalemate Book Review: Day Trading the Currency Markets by Kathy Lien Tuesday July 20th: Profit and 25miles The Beginning.

Trader PsychologyTrades I'm Proud OfTrading Journal by IntradayFX April 30, Out of the Box! This post has no tag Leave comment. Key LearningTrading JournalTrading Networks by IntradayFX April 14, Trades I'm Proud OfTrading Journal by IntradayFX March 31, FX TradingGBPJPYJapan QE Leave comment. Courses by IntradayFX January 26, This post has no tag 22 comments. Trading Journal by IntradayFX January 25, Trading Journal by IntradayFX January 24, Trading Journal by IntradayFX January 17, Trades I'm Proud OfTrading Journal by IntradayFX January 14, This post has no tag 1 comment.

Trading Journal by IntradayFX January 12, Key LearningTrading Journal by IntradayFX January 10, Popular Posts The New Turtles — Trading Traders Knowledge to Action K2A — Greg Secker My Trading Strategies Reminiscences of a Stock Operator Jesse Livermore: Edwin Lefevre Review: Blogroll Ayumi the Novice Dr Brett FX Madness FX Trading Adventures Jules Long and Wrong Surfing the Pips.

Tags 1m forex snapper trading strategy 1min forex strategy 1m momentum Fx Trading strategies 1m trading 1m trend following 15min charts 15m timeframe 30min candles Adventures of a Currency Trader AUDJPY audusd backtesting bank of america bears and bulls Bird Watching in Lion Country book review CHFJPY countertrend trading dailyfx daily pivots eurjpy eurusd forex backtesting forex intraday trading Forex Trading Forex Trading Strategies forex training fx intraday trading FX Trading GBPJPY GBPUSD greg secker international traders conference Intraday Forex trading intraday setups k2a knowledge to action longer timeframe trading forex mark douglas momentum strategy intraday pivot point trading forex Snapper 1m Trading Strategy Trader Psychology trading pattern when not to trade.

Archives April March January December November October September August July June May April March Meta Log in Entries RSS Comments RSS WordPress. Send to Email Address Your Name Your Email Address document. Sorry, your blog cannot share posts by email.