Construct butterfly spread using put options payoff table

A long put butterfly spread is a combination of a short put spread and a long put spread , with the spreads converging at strike B. Ideally, you want the puts with strikes A and B to expire worthless, while capturing the intrinsic value of the in-the-money put with strike C. So the risk vs. However, the odds of hitting the sweet spot are fairly low.

What is a Butterfly Spread?Constructing your butterfly spread with strike B slightly in-the-money or slightly out-of-the-money may make it a bit less expensive to run. This will put a directional bias on the trade. If strike B is higher than the stock price, this would be considered a bullish trade.

If strike B is below the stock price, it would be a bearish trade. Some investors may wish to run this strategy using index options rather than options on individual stocks.

Long Put Butterfly Spread | Butterfly Spreads - The Options Playbook

Strike prices are equidistant, and all options have the same expiration month. Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame.

Long Butterfly Spread with Puts - Fidelity

For this strategy, time decay is your friend. Ideally, you want all options except the put with strike C to expire worthless with the stock precisely at strike B.

After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. If your forecast was correct and the stock price is at or around strike B, you want volatility to decrease. Your main concern is the two options you sold at strike B. A decrease in implied volatility will cause those near-the-money options to decrease in value, thereby increasing the overall value of the butterfly.

In addition, you want the stock price to remain stable around strike B, and a decrease in implied volatility suggests that may be the case. If your forecast was incorrect and the stock price is approaching or outside of strike A or C, in general you want volatility to increase, especially as expiration approaches. An increase in volatility will increase the value of the option you own at the near-the-money strike, while having less effect on the short options at strike B, thereby increasing the overall value of the butterfly.

Options involve risk and are not suitable for all investors. For more information, please review the Characteristics and Risks of Standardized Options brochure before you begin trading options. Options investors may lose the entire amount of their investment in a relatively short period of time. Multiple leg options strategies involve additional risks , and may result in complex tax treatments.

Please consult a tax professional prior to implementing these strategies. Implied volatility represents the consensus of the marketplace as to the future level of stock price volatility or the probability of reaching a specific price point. The Greeks represent the consensus of the marketplace as to how the option will react to changes in certain variables associated with the pricing of an option contract.

There is no guarantee that the forecasts of implied volatility or the Greeks will be correct. System response and access times may vary due to market conditions, system performance, and other factors. TradeKing provides self-directed investors with discount brokerage services, and does not make recommendations or offer investment, financial, legal or tax advice. You alone are responsible for evaluating the merits and risks associated with the use of TradeKing's systems, services or products.

Content, research, tools, and stock or option symbols are for educational and illustrative purposes only and do not imply a recommendation or solicitation to buy or sell a particular security or to engage in any particular investment strategy. The projections or other information regarding the likelihood of various investment outcomes are hypothetical in nature, are not guaranteed for accuracy or completeness, do not reflect actual investment results and are not guarantees of future results.

All investments involve risk, losses may exceed the principal invested, and the past performance of a security, industry, sector, market, or financial product does not guarantee future results or returns. Your use of the TradeKing Trader Network is conditioned to your acceptance of all TradeKing Disclosures and of the Trader Network Terms of Service.

Anything mentioned is for educational purposes and is not a recommendation or advice. The Options Playbook Radio is brought to you by TradeKing Group, Inc.

Securities offered through TradeKing Securities, LLC. The Options Playbook Featuring 40 options strategies for bulls, bears, rookies, all-stars and everyone in between.

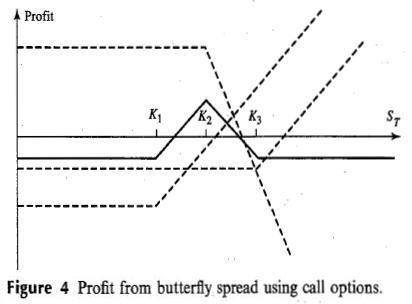

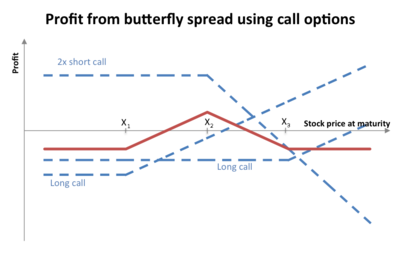

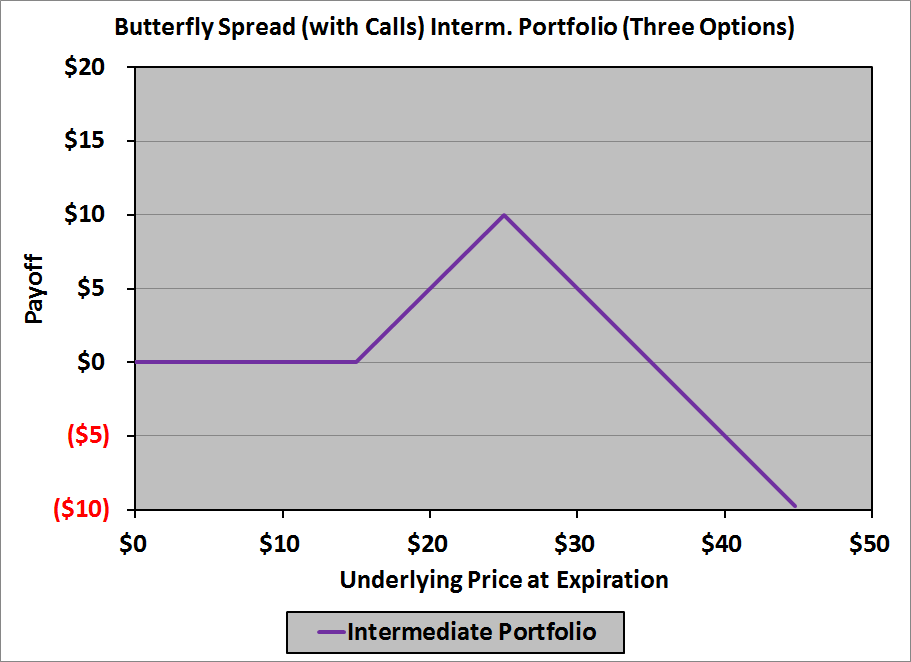

The Strategy A long put butterfly spread is a combination of a short put spread and a long put spread , with the spreads converging at strike B.

Options Guy's Tip Some investors may wish to run this strategy using index options rather than options on individual stocks. The Setup Buy a put, strike price A Sell two puts, strike price B Buy a put, strike price C Generally, the stock will be at strike B NOTE: Who Should Run It Seasoned Veterans and higher NOTE: When to Run It Typically, investors will use butterfly spreads when anticipating minimal movement on the stock within a specific time frame.

Break-even at Expiration There are two break-even points for this play: Strike A plus the net debit paid. Strike C minus the net debit paid.

The Sweet Spot You want the stock price to be exactly at strike B at expiration. Maximum Potential Profit Potential profit is limited to strike C minus strike B minus the net debit paid. Maximum Potential Loss Risk is limited to the net debit paid. TradeKing Margin Requirement After the trade is paid for, no additional margin is required.

As Time Goes By For this strategy, time decay is your friend. Implied Volatility After the strategy is established, the effect of implied volatility depends on where the stock is relative to your strike prices. Today's Trader Network All-Star Trade Report. TradeKing All-Star Webinar Series and Live Events.

Videos, webinars and more Stock trading videos TradeKing All-Star Webinar Series and Live Events Trader Network Forum.