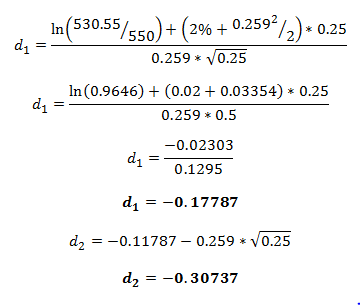

Calculating call option premium

A call is one of the two basic types of options; the other type is a put.

Purchasing a call gives the buyer the option to buy shares at a price listed in the option agreement. This price is known as the strike price. If the price of the underlying stock goes above the strike price, the option is said to be "in the money.

Determine the strike price on the call option. This will be listed along with the rest of the information on the option agreement.

How to Calculate Call Premium - Budgeting Money

Determine the price of the underlying stock on the exercise date. This does not have to be the date of expiration unless it was a European bond.

Calculate the difference between the strike price and the price of the underlying stock on the date the option was exercised. This number should be calculated on a per-share basis.

How to Calculate an Option Premium | The Finance Base

This value will always be positive; a rational investor will never exercise a call option unless the price of the underlying stock exceeds the strike price. Subtract the profit made per share from the difference between the strike price and the stock price when the option was exercised. This is equal to the premium, per share, paid for the call option. Subtract the net profit from the premium collected through selling the option.

How to Calculate Call Premium | ytixoluqit.web.fc2.com

This difference is equal to the premium initially paid to acquire the option. Home Investing General How to Calculate Call Premium.

How to Calculate Call Premium. Share Share on Facebook.

McDonald's Is Now Hiring People Via Snapchat Investing. Can You Guess the Richest County in America?

How to Take Your Next Vacation for Free. How to Do a Balance Sheet Analysis Investing. How to Make Money Buying and Selling Motorcycles Investing. Please enter a valid email.